IDEX Corporation Reports 2008 Results; 9% Orders Growth, 10% Sales Growth, Adjusted EPS up 4%

NORTHBROOK, Ill., Feb 04, 2009 (BUSINESS WIRE) -- IDEX Corporation (NYSE: IEX) today announced its financial results for the three- and twelve-month periods ended December 31, 2008.

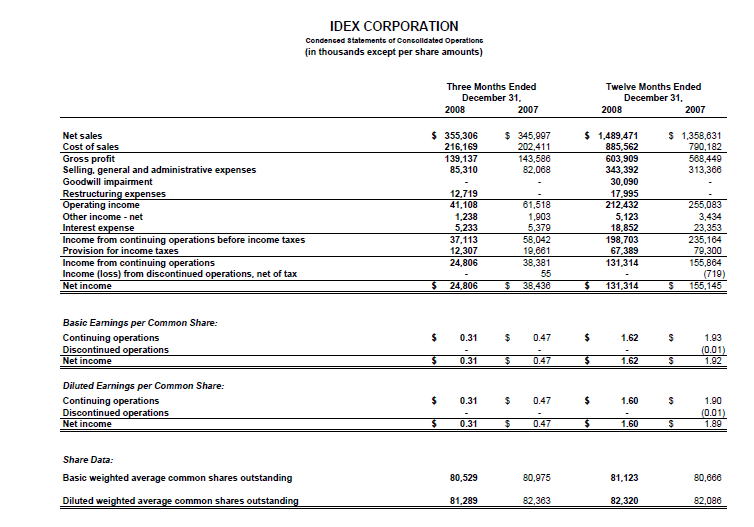

New orders in the quarter totaled $336 million, down 3 percent compared to the prior-year period. Sales in the quarter totaled $355 million, 3 percent higher than the prior-year period (12 percent acquisitions, -5 percent organic and -4 percent foreign currency translation).

Fourth quarter operating income of $41 million was 33 percent lower than the prior-year period. Operating margin of 11.6 percent reflected a 620 basis point decline versus the prior-year period. Excluding the impact of a $12.7 million restructuring-related charge and acquisitions, operating margin was 16.3 percent, down 150 basis points primarily due to lower volume.

Income from continuing operations of $25 million decreased 35 percent versus the fourth quarter of the previous year. Diluted earnings per share from continuing operations of 31 cents declined 16 cents, or 34 percent, from the fourth quarter of the previous year. Excluding the impact of the restructuring-related costs, diluted earnings per share from continuing operations was 41 cents, a decline of 6 cents, or 13 percent, from the fourth quarter of the previous year.

Full Year 2008 Highlights (from Continuing Operations)

- Orders increased 9 percent compared to the prior year (8 percent acquisitions, flat organic and 1 percent foreign currency translation).

- Sales increased 10 percent compared to the prior year (9 percent acquisitions, flat organic and 1 percent foreign currency translation).

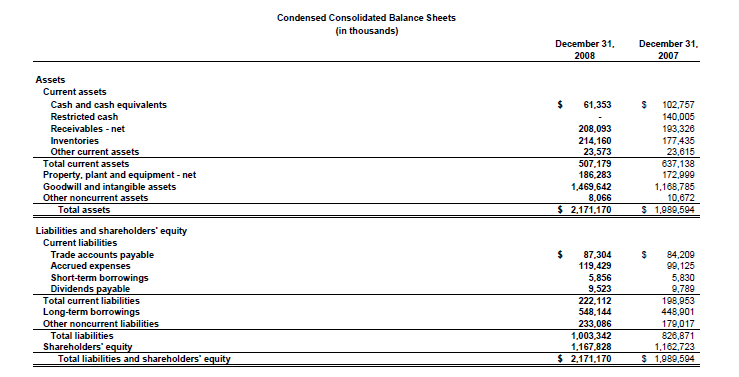

- Income from continuing operations was $131 million, or 16 percent lower than the prior year. Excluding restructuring costs and the Q308 goodwill impairment charge, income from continuing operations was $163 million, or 4 percent ahead of the prior year.

- Diluted EPS of $1.60 was 30 cents, or 16 percent, lower than the prior year. Excluding restructuring costs and the Q308 goodwill impairment charge, diluted EPS of $1.98 was 8 cents, or 4 percent, ahead of the prior year.

- EBITDA of $296 million was 19.9 percent of sales and covered interest expense by more than 15 times.

- Free cash flow of $196 million was 9 percent higher than the prior year and significantly exceeded net income.

- Repurchased 2.3 million shares for $50 million in the fourth quarter of 2008

"Considering the economic downturn in the second half of 2008, I am relatively pleased with the overall performance of our company. We have addressed our cost structure through a combination of two facility closures and a workforce reduction. Our restructuring efforts will result in 2009 cost reductions of $20 million, higher than previously announced, and our recent acquisitions are being integrated as planned and will be accretive in 2009.

The continued deterioration in the economy further impacted our performance during the fourth quarter. Our fourth quarter organic orders were down 10 percent, and given our current outlook, we expect organic revenue to decline at least 10 percent in the first quarter of 2009, with diluted EPS in the range of 32 to 38 cents. Given the current economic conditions, full year 2009 organic revenue is projected to decline 6 to 10 percent. The resulting diluted EPS is expected to range from $1.50 to $1.80.

Our operating model, with a focus on both Commercial and Operational Excellence, will enable us to maintain strong margins, continue to generate significant cash flow and allow us to reinvest for growth."

Lawrence D. Kingsley

Chairman and Chief Executive Officer

Fourth Quarter 2008 Business Highlights (excluding restructuring costs)

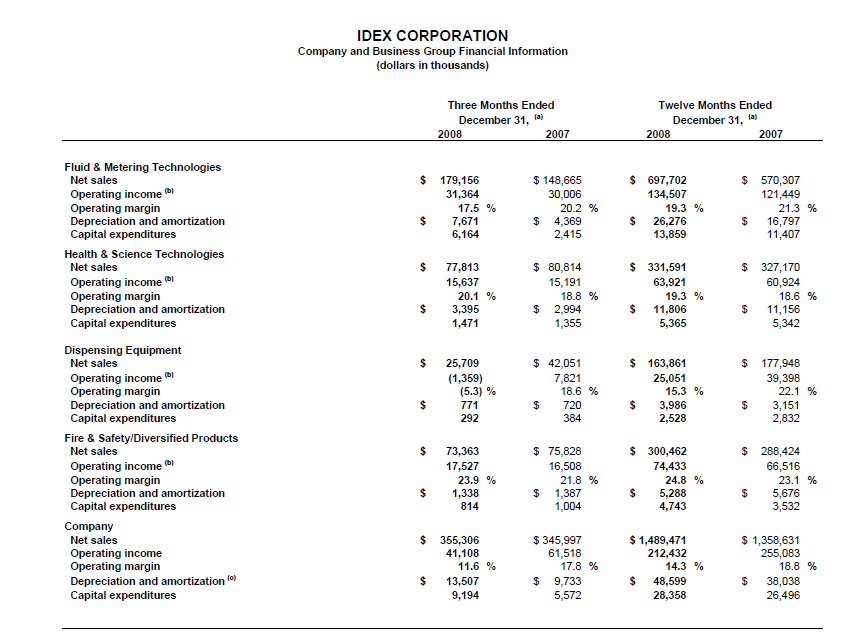

Fluid & Metering Technologies

- Sales in the fourth quarter of $179.2 million reflected 21 percent growth compared to the fourth quarter of 2007 (25 percent acquisitions, -1 percent organic and -3 percent foreign currency translation). Growth was driven by the impact of acquisitions.

- Operating margin of 17.5 percent represented a 270 basis point decline compared with the fourth quarter of 2007, primarily due to the impact of acquisitions. Excluding the impact of acquisitions, operating margin was 21.3 percent, a 110 basis point improvement compared with the prior-year period.

Health & Science Technologies

- Sales in the fourth quarter of $77.8 million reflected a 4 percent decline compared to the fourth quarter of 2007 (5 percent acquisitions, -7 percent organic and -2 percent foreign currency translation). The organic decline was due to general demand softness in the non-core HST businesses.

- Operating margin of 20.1 percent reflected a 130 basis point improvement compared with the fourth quarter of 2007. Excluding the impact of the Semrock acquisition, operating margin was 19.2 percent, a 40 basis point improvement compared with the prior-year period.

Dispensing Equipment

- Sales of $25.7 million in the fourth quarter reflected a 39 percent decline compared with the fourth quarter of 2007 (-33 percent organic and -6 percent foreign currency translation), as a result of continued deterioration in capital spending for both the North American and European markets.

- Operating margin of -5.3 percent represented a significant decline compared with the fourth quarter of 2007 due to much lower volumes in the Americas and Europe.

Fire & Safety/Diversified Products

- Sales in the fourth quarter of $73.4 million reflected a 3 percent decline compared with the prior year (3 percent organic and -6 percent foreign currency translation). Organic growth was driven by demand for fire suppression and rescue equipment serving emerging markets.

- Operating margin of 23.9 percent represented a 210 basis point improvement compared with the fourth quarter of 2007.

For the fourth quarter of 2008, Fluid & Metering Technologies contributed 50 percent of both sales and operating income; Health & Science Technologies accounted for 22 percent of sales and 25 percent of operating income; Dispensing Equipment accounted for 7 percent of sales and -3 percent of operating income; and Fire & Safety/Diversified Products represented 21 percent of sales and 28 percent of operating income.

Restructuring

As previously announced, IDEX has commenced the closure of manufacturing operations in the Dispensing segment's Milan, Italy facility as well as an additional facility consolidation within the Fluid & Metering Technologies segment. IDEX has essentially completed Company-wide restructuring plans which include management and administrative workforce reductions of over 375 employees. The projected savings in costs and operating expenses resulting from these restructuring activities is expected to be $20 million in 2009. The non-recurring severance and non-severance related charges associated with the restructuring were $18 million, recorded in 2008.

Conference Call to be Broadcast over the Internet

IDEX will broadcast its fourth quarter earnings conference call over the Internet on Thursday, February 5, 2009 at 9:30 a.m. CT. Chairman and Chief Executive Officer Larry Kingsley and Vice President and Chief Financial Officer Dominic Romeo will discuss the company's recent financial performance and respond to questions from the financial analyst community. IDEX invites interested investors to listen to the call and view the accompanying slide presentation, which will be carried live on its website at www.idexcorp.com. Those who wish to participate should log on several minutes before the discussion begins. After clicking on the presentation icon, investors should follow the instructions to ensure their systems are set up to hear the event and view the presentation slides, or download the correct applications at no charge. Investors also will be able to hear a replay of the call by dialing 888.203.1112 or 719.457.0820 and using conference ID #1364347.

A Note on EBITDA and Free Cash Flow

EBITDA means earnings before interest, income taxes, depreciation and amortization and non-recurring non-cash charges, while free cash flow means cash flow from operating activities less capital expenditures plus the excess tax benefit from stock-based compensation. Management uses these non-GAAP financial measures as internal operating metrics and for enterprise valuation purposes. Management believes these measures are useful as analytical indicators of leverage capacity and debt servicing ability, and uses them to measure financial performance as well as for planning purposes. However, they should not be considered as alternatives to net income, cash flow from operating activities or any other items calculated in accordance with U.S. GAAP, or as an indicator of operating performance. The definitions of EBITDA and free cash flow used here may differ from those used by other companies.

|

EBITDA and |

For the Quarter Ended |

For the Year Ended | |||||||||||||||||||||||||

|

December 31, |

September 30, |

December 31, | |||||||||||||||||||||||||

|

2008 |

2007 |

Change |

2008 |

Change |

2008 |

2007 |

Change |

||||||||||||||||||||

|

Inc before Taxes |

$37.1 | $58.0 | (36 | ) | % | $28.3 | 31 | % | $198.7 | $235.2 | (16 | ) | % | ||||||||||||||

|

Depr & Amort |

13.5 | 9.7 | 39 | 10.9 | 24 | 48.6 | 38.0 | 28 | |||||||||||||||||||

|

GW Impm't |

- | - | - | 30.1 | na | 30.1 | - | na | |||||||||||||||||||

|

Interest |

5.2 | 5.4 | (3 | ) | 3.9 | 36 | 18.9 | 23.4 | (19 | ) | |||||||||||||||||

|

EBITDA |

$55.8 | $73.1 | (24 | ) | $73.2 | (24 | ) | $296.3 | $296.6 | - | |||||||||||||||||

|

Cash Flow from Op Activities |

$53.9 |

$59.9 |

(10 |

) |

% |

$72.9 |

(26 |

) |

% |

$220.6 |

$198.1 |

11 |

% | ||||||||||||||

|

Capital Exp |

(8.7 | ) | (5.7 | ) | 52 | (5.9 | ) | 48 | (27.8 | ) | (24.5 | ) | 14 | ||||||||||||||

|

Excess Tax Benefit from Stock-Based Compensation |

0.2 |

0.7 |

(69 |

) |

0.6 |

(60 |

) |

3.1 |

5.4 |

(42 |

) |

||||||||||||||||

|

Free Cash Flow |

$45.4 | $54.9 | (17 | ) | $67.6 | (33 | ) | $195.9 | $179.0 | 9 | |||||||||||||||||

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. These statements may relate to, among other things, capital expenditures, cost reductions, cash flow, and operating improvements and are indicated by words or phrases such as "anticipate," "estimate," "plans," "expects," "projects," "should," "will," "management believes," "the company believes," "the company intends," and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this news release. The risks and uncertainties include, but are not limited to, the following: economic and political consequences resulting from terrorist attacks and wars; levels of industrial activity and economic conditions in the U.S. and other countries around the world; pricing pressures and other competitive factors, and levels of capital spending in certain industries - all of which could have a material impact on order rates and IDEX's results, particularly in light of the low levels of order backlogs it typically maintains; its ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the company operates; interest rates; capacity utilization and the effect this has on costs; labor markets; market conditions and material costs; and developments with respect to contingencies, such as litigation and environmental matters. The forward-looking statements included here are only made as of the date of this news release, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here.

About IDEX

IDEX Corporation is an applied solutions company specializing in fluid and metering technologies, health and science technologies, dispensing equipment, and fire, safety and other diversified products built to its customers' exacting specifications. Its products are sold in niche markets to a wide range of industries throughout the world. IDEX shares are traded on the New York Stock Exchange and Chicago Stock Exchange under the symbol "IEX".

For further information on IDEX Corporation and its business units, visit the company's Web site at www.idexcorp.com.

(Tables follow)

SOURCE: IDEX Corporation

IDEX Corporation

Investor Contact:

Heath Mitts

Vice President - Corporate Finance

(847) 498-7070

Copyright Business Wire 2009